Okay, let’s talk Mahindra & Mahindra (M&M). We’re not just looking at stock prices here, but at a potential shift in your investment portfolio. The buzz is that Mahindra & Mahindra share price target for 2025 could see a significant jump – some experts are even throwing around the 4x growth number in five years. Sounds exciting, right? But before you jump in, let’s dissect what’s driving these predictions and whether they hold water. Here’s the thing: it’s not just about the numbers; it’s about understanding the ‘why’ behind them.

Decoding the Optimism | Why the Bullish Forecast?

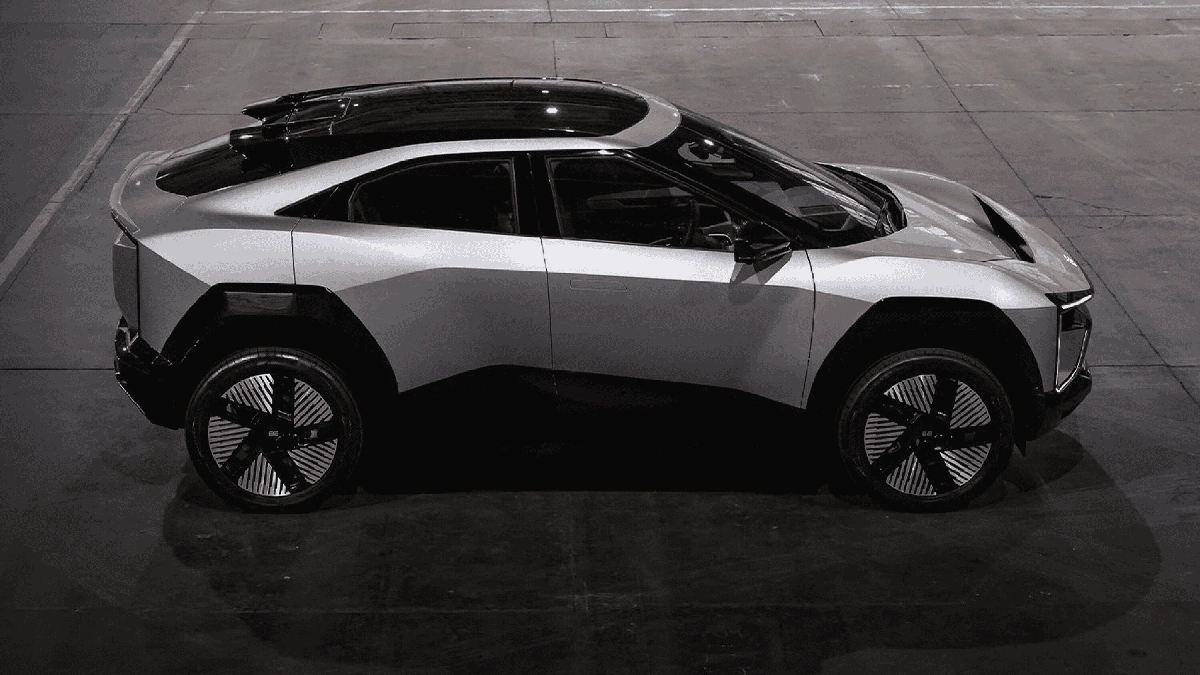

So, why are analysts so hyped up about M&M? It boils down to a few key factors. First off, M&M has been making some serious moves in the EV space. Their electric vehicle offerings are getting a lot of attention, and that market is only going to grow. Then, there’s the overall economic outlook for India. A growing economy typically translates to increased demand for vehicles – both passenger and commercial – which is right in M&M’s wheelhouse. But there’s more.

And, Mahindra isn’t just relying on EVs. Their traditional SUV business is still strong. The company has consistently delivered popular models, maintaining its market share. A common mistake I see people make is to underestimate the value of a company’s existing strengths while focusing solely on new ventures. M&M seems to be balancing both quite well. The question of long-term investment value is critical here.

Consider also that Mahindra & Mahindra’s rural and semi-urban penetration is excellent. The company understands the Indian market deeply, and that gives it a considerable advantage. As per reports, their focus on farm equipment further diversifies their income streams and strengthens their financial position. All this contributes to the overall positive sentiment.

The EV Factor | A Game Changer or Just Hype?

Let’s be honest, the electric vehicle market is where everyone’s attention is right now. But is the hype justified when it comes to Mahindra & Mahindra? I think it is, but with a caveat. The EV market in India is still developing, and there are challenges around infrastructure (charging stations, primarily) and affordability. However, M&M seems to be taking a proactive approach. They are not just launching EVs; they are also investing in the charging infrastructure and exploring innovative financing options. So, it may be wise to look at stock analysis focusing on automotive industry trends .

What fascinates me is Mahindra’s strategy of not just focusing on high-end EVs. They also seem to be targeting the mass market, which could be a smart move. After all, the real growth in India will come from affordable EVs that cater to the average consumer. I initially thought this was straightforward, but then I realized the interplay of government policies and subsidies. These can significantly impact the affordability and adoption of EVs. According to various reports, the government is keen on promoting EVs, and any favorable policies would be a huge boost for M&M.

Risk Factors | What Could Derail the Growth Story?

Now, let’s pump the brakes a little. No investment is without risk, and M&M is no exception. A major factor to consider is the competition. The Indian stock market is becoming increasingly crowded, with both domestic and international players vying for a piece of the EV pie. M&M needs to stay ahead of the curve in terms of technology and pricing.

Another risk factor is the global economic situation. A slowdown in the global economy could impact demand for vehicles, both in India and abroad. Also, fluctuations in commodity prices (especially steel and aluminum) could affect M&M’s profitability. Let me rephrase that for clarity: external economic factors, largely outside of M&M’s direct control, could significantly impact their performance.

And, let’s not forget regulatory changes. Any changes in government policies related to the automotive industry (e.g., emission norms, taxation) could also have an impact. It’s crucial to stay updated on these factors. Keep an eye on industry news and government announcements to get a better sense of the potential risks. It can be helpful to consult a financial advisor before making any decisions.

Practical Steps | How to Approach This Investment Opportunity

So, you’re intrigued by the potential of M&M. What now? Here’s the “How” angle: don’t just blindly follow the predictions. Do your homework. Research. Understand the company’s financials, its strategy, and the risks involved. Start by looking at their annual reports, investor presentations, and analyst reports. Read news articles and follow industry experts on social media to stay updated on the latest developments.

More importantly, don’t put all your eggs in one basket. Diversify your portfolio. M&M could be a good addition to your portfolio, but it shouldn’t be your only investment. A common mistake I see people make is over-investing in a single stock based on hype. Spread your risk across different sectors and asset classes. This is especially important if you’re new to investing. It is important to understand share market trends .

Finally, have a long-term perspective. Investing in the stock market is a marathon, not a sprint. Don’t expect to get rich overnight. Be prepared to ride out the ups and downs of the market. If you are looking at the future stock performance , remember that patience and discipline are your best friends.

What’s the Final Word?

The potential for M&M to grow 4x in 5 years is certainly appealing. The company has a lot going for it: a strong brand, a solid presence in the Indian market, and a promising foray into the EV space. However, it’s important to remember that these are just predictions. The future is uncertain, and there are risks involved. Approach this investment opportunity with caution, do your research, and diversify your portfolio. It’s best to keep checking the official portal. Remember to view it as an investment for the long term , and not a get-rich-quick scheme.

FAQ

What factors could negatively impact Mahindra & Mahindra’s share price?

Increased competition, economic downturns, fluctuations in commodity prices, and changes in government regulations are key factors.

Is Mahindra & Mahindra a good long-term investment?

It has potential, given its EV initiatives and market position, but careful research and diversification are crucial.

What is the ideal investment strategy for M&M stocks?

A long-term perspective with a diversified portfolio is generally recommended.

Where can I find reliable information about Mahindra & Mahindra’s financial performance?

Annual reports, investor presentations, and reputable financial news sources are good starting points.

What if I’m new to the stock market?

Consider consulting a financial advisor and investing in index funds or ETFs to start.

How does the automotive industry affect Mahindra & Mahindra’s stock value?

The automotive industry affects Mahindra & Mahindra’s stock value as this industry contributes to their overall sales .

Leave feedback about this