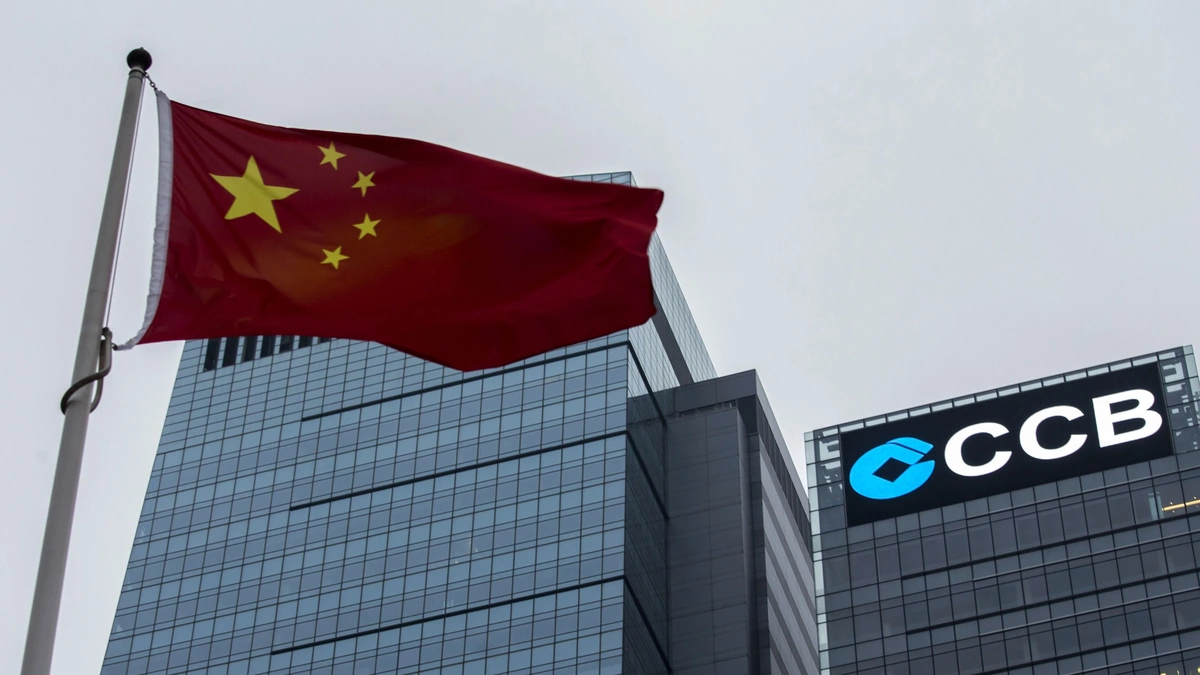

India’s financial landscape is undergoing a fascinating transformation. It’s not just about more banks opening branches; it’s about a fundamental shift in how global financial institutions view and engage with the Indian market. Regulatory changes have acted as a catalyst, prompting a noticeable surge in the presence and activities of international banks across the country. But the real question is: why now ? And what does this mean for the average Indian citizen and the broader economy?

Decoding the Regulatory Shift

Let’s be honest, regulatory changes can often feel like navigating a bureaucratic maze. But in this case, they’re the key to unlocking this influx of foreign banks . What fascinates me is the subtle yet significant ways in which these changes have made India a more attractive destination for global players. Think of it as India rolling out the welcome mat, making it easier for these institutions to set up shop and operate efficiently.

Specifically, revisions to the banking regulations around capital requirements, branch licensing, and permitted activities have played a crucial role. The government’s push towards greater transparency and ease of doing business has also boosted confidence among overseas banks . This isn’t just about ticking boxes; it’s about creating an environment where these banks feel secure and see long-term potential. According to a report by the Reserve Bank of India , these changes were implemented after careful consideration of international best practices and with the goal of fostering a more competitive and dynamic banking sector.

The “Why” Angle | Implications for the Indian Economy

So, why does this surge matter? Beyond the headlines, what’s the real impact? The answer, I believe, lies in the potential for increased competition, innovation, and access to a wider range of financial services for Indian businesses and individuals. More international banking groups present in India directly correlates to heightened competition within the banking sector. And you know what happens with competition? Better rates, better services, and more choices for consumers.

Foreign investment in India’s banking sector can bring much-needed capital, expertise, and technology. It can help modernize the banking infrastructure, improve risk management practices, and introduce innovative products and services that cater to the evolving needs of the Indian market. This influx can also stimulate economic growth by providing more financing options for businesses, particularly small and medium-sized enterprises (SMEs), which often struggle to access credit. Related to sales . More foreign investment can lead to overall growth.

But let’s not paint an entirely rosy picture. Increased competition can also put pressure on existing domestic banks, potentially leading to consolidation or even failures. It’s crucial for the government and regulatory bodies to ensure a level playing field and to provide adequate support to domestic banks to help them adapt to the changing landscape. Furthermore, the entry of global banks can also pose challenges in terms of regulatory oversight and ensuring compliance with local laws and regulations.

Navigating the New Landscape | Opportunities for Indian Businesses

For Indian businesses, particularly those with global aspirations, this surge of multinational banks presents a significant opportunity. These banks often have extensive international networks and expertise in cross-border transactions, making them ideal partners for companies looking to expand their operations overseas. They can provide access to a wider range of financial products and services, including trade finance, foreign exchange hedging, and international payments.

However, it’s important for businesses to do their homework and carefully evaluate their options before choosing a banking partner. Not all global banks are created equal, and their strengths and areas of expertise can vary significantly. Businesses should consider factors such as the bank’s experience in their industry, its global network, its range of products and services, and its commitment to the Indian market. What initially thought was straightforward, it turned out to be way more nuanced. The key is to find a bank that understands their specific needs and can provide tailored solutions to help them achieve their goals.

The Future of Banking in India | A Globalized Ecosystem

The surge of global banks in India is not just a temporary phenomenon; it’s a sign of a larger trend towards greater globalization of the Indian economy. As India continues to integrate with the global financial system, we can expect to see even more foreign banks entering the market, bringing with them new ideas, technologies, and best practices. This will undoubtedly lead to a more competitive and dynamic banking sector, ultimately benefiting Indian businesses and consumers.

But the success of this globalization hinges on a few critical factors. First, the government must continue to pursue regulatory reforms that promote transparency, ease of doing business, and a level playing field for all players. Second, regulatory bodies must strengthen their oversight capabilities to ensure that foreign banks comply with local laws and regulations and do not pose a risk to the financial system. Third, domestic banks must embrace innovation and adapt to the changing landscape to remain competitive. Only then can India fully reap the benefits of a globalized banking ecosystem.

And here’s the thing: the relationship isn’t one-way. As global banks set up operations in India, this also creates opportunities for skilled Indian professionals to work in international environments. This facilitates a knowledge exchange and further strengthens India’s position in the global market. More investment means more movement . This can lead to more growth in the long run.

FAQ Section

Frequently Asked Questions

What are the primary reasons behind the recent surge of global banks in India?

Regulatory reforms aimed at increasing transparency and ease of doing business, coupled with India’s growing economy and potential for long-term growth, are the main drivers.

How does the entry of international banks impact the average Indian consumer?

Increased competition among banks can lead to better interest rates, improved services, and a wider range of financial products for consumers.

What are the potential risks associated with the growing presence of foreign banks in India?

Potential risks include increased competition for domestic banks, challenges in regulatory oversight, and the need to ensure compliance with local laws.

How can Indian businesses benefit from the presence of global banks?

Global banks can provide access to international networks, expertise in cross-border transactions, and a wider range of financial products and services for businesses looking to expand globally.

What role does the Reserve Bank of India (RBI) play in regulating foreign banks operating in India?

The RBI is responsible for overseeing and regulating all banks operating in India, including foreign banks , to ensure financial stability and compliance with regulations.

Are there specific sectors within the Indian economy that are particularly attractive to global banks?

Infrastructure, renewable energy, and technology are sectors that often attract significant interest from foreign banks due to their growth potential and investment opportunities.

Leave feedback about this