So, Groww’s Q2 earnings are out, and the stock took a bit of a tumble. Now, the knee-jerk reaction might be to just look at the numbers and say, “Oh, it’s down, must be bad.” But here’s the thing: the why behind the movement is often way more interesting and important than the movement itself. Think of it like this: knowing the stock price is like knowing the score of a cricket match, understanding the why is like understanding the strategies, the player performances, and the overall game dynamics. This isn’t just about numbers; it’s about context, future implications, and what it all means for you, the investor.

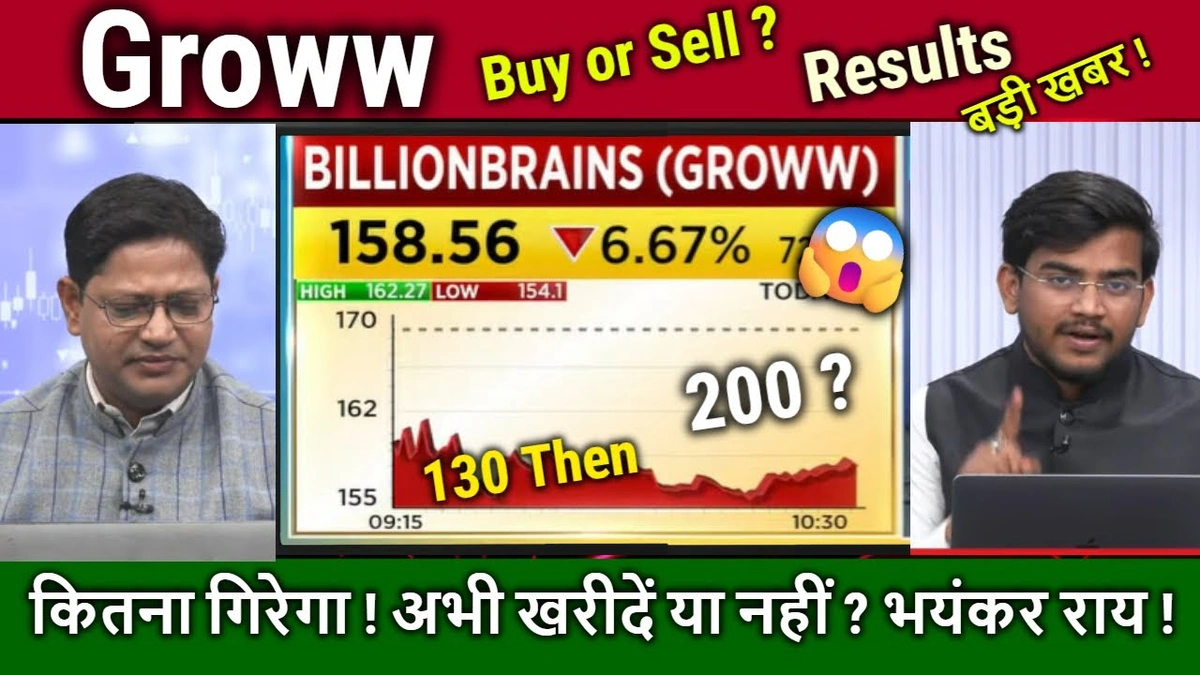

Decoding the Dip | Why Did Groww’s Stock Fall?

Let’s be honest, stock market reactions are rarely straightforward. Several factors could be at play here. First, we need to look at the Groww results themselves. Were the earnings lower than analysts expected? Sometimes, even if a company is doing well, if it doesn’t meet the sky-high expectations, the stock can suffer. Second, market sentiment plays a huge role. If the overall market is jittery due to, say, global economic concerns or rising interest rates, even good news might not be enough to lift a stock. It’s like trying to launch a kite in a storm – tough, right?

Another factor? Profit booking. Investors who bought the stock earlier might see the earnings announcement as a good time to cash in their gains, leading to a temporary dip. Plus, we can’t ignore the competition. What are other investment platforms doing? Are they offering better deals or features that are drawing investors away from Groww? Understanding the competitive landscape is key. Also, keep an eye on regulatory changes in the investment sector, as these can significantly impact investor sentiment. For instance, recent SEBI guidelines may have led to some investors re-evaluating their portfolios.

The Bigger Picture | What Do These Earnings Signify?

Okay, so the stock dipped. But what does that really mean? Well, it’s a snapshot in time, and the stock market is like a living organism, always reacting and adapting. Zooming out, we need to ask: are Groww’s fundamentals still strong? Is the company still innovating? Is it still attracting new users? A short-term dip doesn’t necessarily mean the long-term story has changed. What fascinates me is that sometimes a dip can be an opportunity.

Think of it as a sale on your favourite gadget – if you believed in the product before, a lower price might just be the perfect entry point. But – and this is a big ‘but’ – you need to do your homework first. Don’t just blindly buy the dip because some ‘expert’ on TV told you to. Understand the company, its future prospects, and your own risk tolerance. Speaking of risk, have you considered the impact of market volatility on your portfolio? It’s essential to have a diversified investment strategy to mitigate potential losses. Now, let’s pivot to what you should do as an investor.

Investor’s Playbook | Navigating the Groww Results

So, what should you, as a savvy investor, do with this information? First, don’t panic sell ! I know, easier said than done. But emotional decisions rarely lead to good outcomes in the stock market. Instead, take a deep breath, review your investment thesis, and ask yourself if anything has fundamentally changed. Has Groww’s business model been disrupted? Has its competitive advantage eroded? If the answer is no, then this dip might just be a blip on the radar.

Second, use this as an opportunity to rebalance your portfolio. Maybe you were overexposed to Groww, and this dip is a good reminder to diversify. Remember, don’t put all your eggs in one basket! Third, stay informed. Keep an eye on Groww’s future announcements, industry trends, and overall market conditions. Knowledge is power, especially when it comes to investing. For further reading on portfolio diversification, check out this article on short-term investment strategies .

And let’s be real, investing isn’t just about chasing high returns. It’s also about understanding risk and managing your emotions. A common mistake I see people make is getting caught up in the hype and forgetting their own financial goals. Are you investing for retirement? For your children’s education? Your investment decisions should always align with your long-term objectives. Understanding financial planning is essential for making informed investment choices.

Looking Ahead | Groww’s Future Prospects

Okay, crystal ball time (sort of). What’s next for Groww? Well, it depends on a number of factors. Can the company continue to innovate and attract new users? Can it effectively compete with other investment platforms? Can it navigate the ever-changing regulatory landscape? These are all crucial questions.

Personally, what fascinates me is Groww’s potential to tap into the vast untapped market of first-time investors in India. With increasing internet penetration and financial literacy, there’s a huge opportunity to bring more people into the fold. But it’s not just about growth; it’s about sustainable growth. Can Groww maintain its user-friendly interface and educational resources as it scales? Can it build trust and credibility with its users? These are the challenges that will determine its long-term success. Moreover, keep an eye on Groww’s expansion plans into other financial services, such as lending and insurance. This diversification could significantly impact its future performance.

Also, don’t forget to compare Groww’s performance with other key players in the Indian fintech space. Companies like Zerodha and Upstox are also vying for market share. A detailed competitive analysis can provide valuable insights into Groww’s strengths and weaknesses.

Conclusion | The Long Game of Investing

Investing is a marathon, not a sprint. A single earnings announcement and a stock price dip shouldn’t derail your long-term strategy. Instead, use this as an opportunity to learn, adapt, and refine your approach. Remember, the stock market is a complex and unpredictable beast. But with knowledge, discipline, and a little bit of patience, you can navigate its ups and downs and achieve your financial goals. Don’t let short-term noise distract you from the long-term signal.

Before making any investment decisions, consider consulting a financial advisor. They can provide personalized guidance based on your individual circumstances. You can also research more on investment on Wikipedia.

FAQ Section

What if I’m new to investing?

Start small, educate yourself, and don’t be afraid to ask for help. There are plenty of resources available online and offline to guide you. Consider investing in mutual funds or ETFs initially to diversify your portfolio.

Is Groww a safe platform to invest in?

Groww is a registered platform regulated by SEBI. However, like any investment platform, it’s subject to market risks. Do your research and understand the risks involved before investing.

How often should I check my portfolio?

It depends on your investment style and goals. Generally, it’s a good idea to review your portfolio at least quarterly to ensure it aligns with your objectives and risk tolerance. For more information on financial topics, check out this article on business performance.

What are the tax implications of investing through Groww?

Capital gains tax applies to profits earned from selling investments. The tax rate depends on the holding period and the type of asset. Consult a tax advisor for specific guidance.

What is direct mutual funds , and should I be investing in them through Groww?

Direct mutual funds do not have distributor commissions, which generally leads to better returns. However, you’ll need to do your own research to select the right funds.

Where can I find information regarding Groww brokerage charges?

Groww brokerage charges are published on their website. It is best to check for the most up-to-date information.

Leave feedback about this