Alright, let’s dive into the exhilarating world of the Indian stock market. Specifically, we’re looking at November 21st, a day that saw the Nifty aiming for 26,000 and the Sensex eyeing 85,500. But here’s the thing: it’s not just about the numbers; it’s about understanding why certain stocks soared while others stumbled. It’s about the undercurrents that shape the market’s daily dance.

Today we’re going to break down NSE BSE Gainers and Losers , moving beyond the simple headlines to explore the ‘why’ behind the movements. Consider this your backstage pass to understanding the market. What factors influenced Maruti and M&M to emerge as top gainers? What does this tell us about the broader market sentiment? And, more importantly, what can you, as an investor, learn from all of this?

Decoding the Gainers | Maruti and M&M

Let’s start with Maruti Suzuki and Mahindra & Mahindra (M&M). Both emerged as top gainers on November 21st. But, why? A simple answer is that positive sales data or a promising new product launch drove investor confidence. But that’s surface-level analysis. Here’s where we dig deeper. What fascinates me is the resilience of these companies amidst a fluctuating economy. Maruti, for instance, has consistently navigated challenges like supply chain disruptions and changing consumer preferences. M&M, on the other hand, has doubled down on its SUV segment and electric vehicle initiatives.

Could it be a surge in demand for automobiles, fueled by the festive season? Or perhaps it’s the result of government policies incentivizing vehicle purchases. Maybe, just maybe, it’s a combination of all these factors, interwoven with global market trends and investor sentiment. According to market analysts atMoneycontrol.com, the auto sector was showing signs of recovery around that time, buoyed by easing chip shortages. This allows manufacturers to fulfill pending orders and improve production volumes. Stock market analysis often involves connecting these seemingly disparate dots to paint a complete picture.

Understanding Market Sentiment and Sectoral Trends

The performance of the NSE and BSE on any given day is not just a random occurrence. It’s a reflection of the overall market sentiment. When the Nifty aims for 26,000 and the Sensex flirts with 85,500, it suggests a bullish trend investors are generally optimistic. But that optimism can be fragile, influenced by a myriad of factors, from global economic news to domestic policy announcements. What fascinates me is how quickly sentiment can shift. A single tweet from a prominent economist or an unexpected policy change can send ripples through the market.

Sectoral trends also play a crucial role. Were the gains broad-based, or were they concentrated in specific sectors like auto, IT, or finance? Understanding which sectors are driving the market’s upward trajectory can provide valuable insights. For example, if the IT sector is leading the charge, it could indicate confidence in the country’s technological prowess and export potential. However, if the gains are primarily driven by the financial sector, it might suggest optimism about the overall economic outlook.

Let’s be honest, interpreting these trends is more art than science. It requires a blend of analytical skills, industry knowledge, and a healthy dose of intuition.

The Broader Economic Context

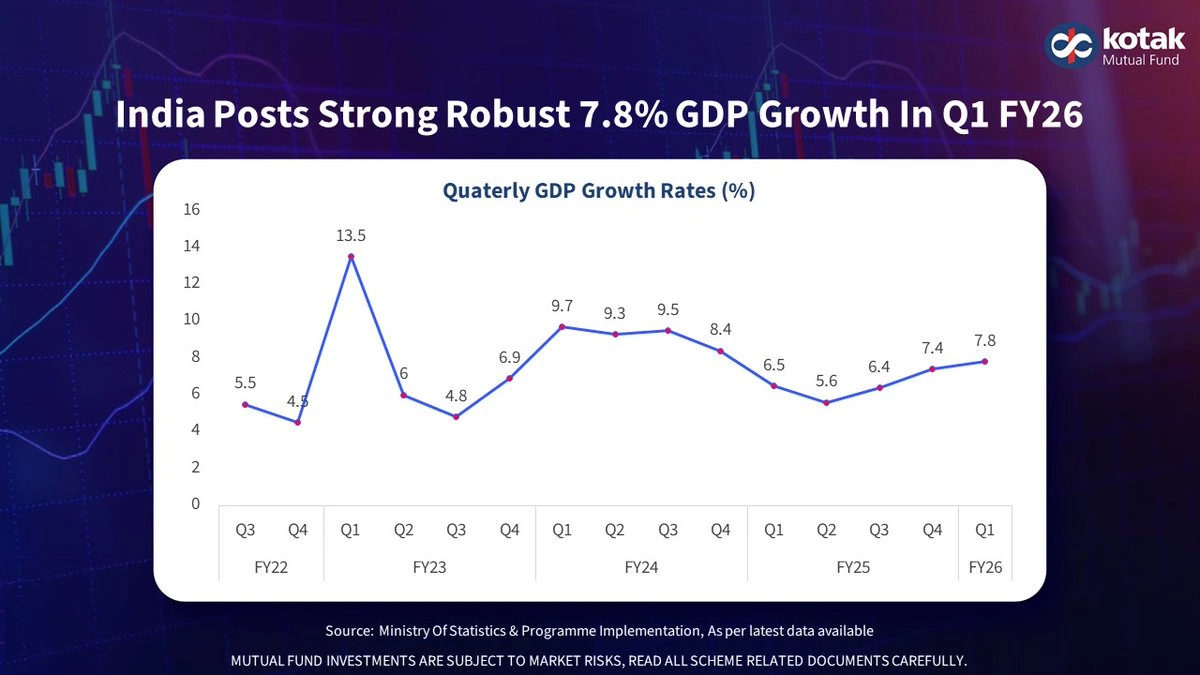

The stock market doesn’t exist in a vacuum; it’s deeply intertwined with the broader economic context. Factors like inflation, interest rates, and GDP growth all influence investor sentiment and market performance. So, what was the economic landscape like on November 21st? Were there any significant economic announcements that could have triggered the market movements we observed?

For instance, if inflation was under control and interest rates were stable, it would likely create a favorable environment for businesses and investors alike. Conversely, rising inflation or unexpected interest rate hikes could dampen sentiment and trigger a market correction. I initially thought this was straightforward, but then I realized that the relationship between economic indicators and market performance is not always linear. Sometimes, the market anticipates future economic conditions, reacting to potential risks or opportunities before they fully materialize. It’s this anticipatory nature of the market that makes it both fascinating and challenging to navigate.

Lessons for the Indian Investor

So, what can you, as an investor in India, learn from the market movements of November 21st? Here are a few key takeaways. First, don’t get swayed by the headlines. Dig deeper to understand the underlying factors driving market movements. Second, pay attention to sectoral trends. Knowing which sectors are performing well can help you identify potential investment opportunities. Third, stay informed about the broader economic context. Economic indicators can provide valuable clues about the market’s future direction. Fourth, diversify your portfolio. Spreading your investments across different asset classes can help mitigate risk.

A common mistake I see people make is chasing quick profits without understanding the fundamentals. Remember, investing is a marathon, not a sprint. It requires patience, discipline, and a long-term perspective. As per SEBI , always conduct thorough research and seek professional advice before making any investment decisions. Also, it is important to monitor your portfolio regularly and adjust your investment strategy as needed.

The one thing you absolutely must remember is that the market is inherently unpredictable. There will be days when everything goes your way, and there will be days when nothing seems to work. The key is to stay calm, stay informed, and stick to your investment plan. Also, if you’re interested in how memory impacts processing speed, check out LP DDR memory .

Remember that the Top Gainers NSE and BSE Losers are constantly changing, reflecting dynamic market conditions.

Final Thoughts | The Market’s Ever-Changing Narrative

Ultimately, the stock market is a story a narrative of economic progress, corporate innovation, and human ambition. By understanding the characters, plot twists, and underlying themes of this story, you can become a more informed and successful investor. The events of November 21st, with the Nifty’s ambitious climb and the Sensex’s optimistic outlook, offer a snapshot of this ongoing narrative. Embrace the complexity, learn from the past, and prepare for the future.

The Indian stock market is a dynamic, evolving landscape, full of opportunities and challenges. By staying informed, being patient, and adopting a long-term perspective, you can navigate this landscape successfully and achieve your financial goals. Always analyze the stock market performance before investing.

FAQ Section

What factors typically influence the performance of NSE and BSE?

The performance of the NSE and BSE is influenced by a combination of domestic and global factors, including economic indicators like GDP growth and inflation, corporate earnings, government policies, and global market trends.

How can I identify potential investment opportunities in the Indian stock market?

You can identify potential investment opportunities by conducting thorough research, analyzing sectoral trends, monitoring economic indicators, and seeking advice from financial professionals.

What are some common mistakes that investors make in the stock market?

Some common mistakes include chasing quick profits, not diversifying their portfolios, and failing to stay informed about market conditions.

What role does investor sentiment play in stock market movements?

Investor sentiment plays a significant role in stock market movements. Optimism can drive prices higher, while pessimism can lead to sell-offs.

How can I mitigate risk in the stock market?

You can mitigate risk by diversifying your portfolio, investing in quality stocks, and adopting a long-term investment strategy.

Where can I find reliable information about the Indian stock market?

You can find reliable information from reputable financial news sources, brokerages, and regulatory bodies like SEBI.

Leave feedback about this