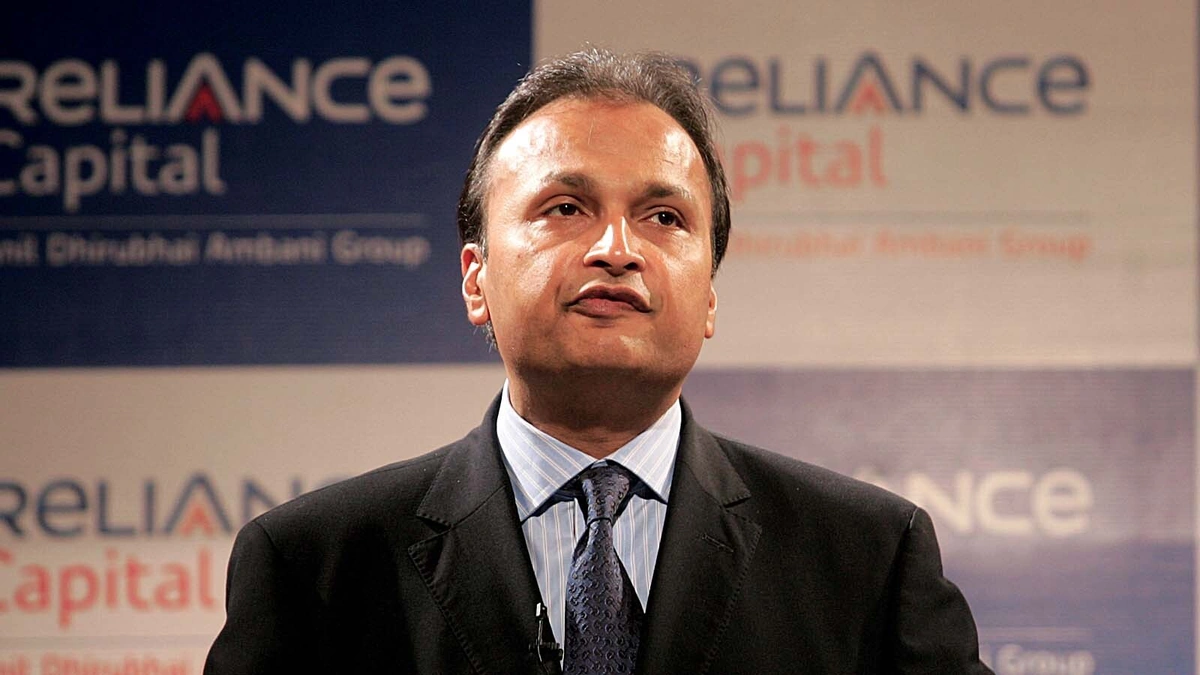

So, the Enforcement Directorate (ED) has swooped in and attached a whopping ₹3,084 crore worth of assets belonging to the Reliance Group in connection with a money laundering case involving Anil Ambani’s firms. Let’s be honest, headlines like this can feel… distant. Like it’s happening in some other world. But here’s the thing: it matters to you, the average Indian, more than you might think. Why? Because it touches on the integrity of our financial system, impacts investor confidence, and raises questions about how business is done at the highest levels. And that, my friend, affects us all. This is a significant development in the ongoing saga surrounding Anil Ambani and his financial dealings, and it warrants a closer look. We’re not just talking about numbers here; we’re talking about trust, accountability, and the future of Indian business. Let’s dive in.

The “Why” Behind the Attachment

The burning question is, of course, why? Why this action now, and what’s the big deal? Well, the ED alleges that these assets are proceeds of crime derived from money laundering activities. Specifically, they claim that Anil Ambani’s firms were involved in diverting funds and creating a complex web of transactions to conceal illicit wealth. According to reports, the attached assets include land, buildings, and shares held in various companies. The ED’s move is based on the Prevention of Money Laundering Act (PMLA), which allows them to seize assets believed to be linked to illegal activities. A common mistake I see people make is thinking this is just about one person’s alleged wrongdoing. It’s bigger than that. It’s about sending a message that no one is above the law, and that financial crimes will be pursued relentlessly. This also involves investigation of financial irregularities . The attachment is a provisional one, meaning it’s not permanent yet. The ED will now present its case before the Adjudicating Authority, which will decide whether to confirm the attachment or release the assets. This process can take months, even years. But make no mistake, this is a serious blow to Anil Ambani and his group. What fascinates me is how these complex financial schemes are uncovered. It requires painstaking investigation, forensic accounting, and a deep understanding of corporate structures. And it all starts with suspicion – a tip-off, a red flag, or a whistleblower willing to speak up.

Implications for Reliance Group and Investors

So, what does all this mean for the Reliance Group, its investors, and the wider market? Let me rephrase that for clarity… It’s not pretty. First, it’s a massive reputational hit. No investor wants to be associated with a company under investigation for money laundering . This can lead to a further erosion of investor confidence and a decline in share prices. Second, it puts a question mark over the group’s ability to raise funds and conduct business as usual. Lenders may become more cautious, and new projects could be put on hold. Third, it raises concerns about the overall health of the group. Anil Ambani’s Reliance Group has been struggling with debt for years, and this latest development only adds to its woes. A common mistake I see people make is thinking such actions are isolated events. They can have a domino effect, triggering further investigations, legal battles, and financial distress. The one thing you absolutely must double-check is your own investment portfolio. Are you exposed to any Reliance Group companies? If so, it’s time to reassess your risk and make informed decisions. According to legal experts, the ED’s actions could also trigger cross-default clauses in loan agreements, potentially leading to a cascade of defaults. This is a worst-case scenario, but it’s a risk that cannot be ignored. This situation highlights the importance of corporate governance and transparency in financial dealings.

Anil Ambani’s Troubled Waters | A Deeper Dive

Anil Ambani, once a titan of Indian industry, has seen his fortunes decline dramatically in recent years. His Reliance Group, which once rivaled that of his brother Mukesh Ambani, has been plagued by debt, legal battles, and allegations of financial mismanagement. But, how did it come to this? Well, a combination of factors contributed to his downfall. Aggressive expansion, risky investments, and a failure to adapt to changing market conditions all played a role. Let’s be honest, building a business empire is never easy. It requires vision, execution, and a bit of luck. But it also requires prudence, transparency, and a commitment to ethical practices. And that’s where, some argue, Anil Ambani faltered. The Prevention of Money Laundering Act (PMLA) is a powerful tool in the hands of the ED, and it’s being used more and more frequently to target financial crimes. This is a welcome development, as it sends a clear message that those who engage in illegal activities will be held accountable. The Anil Ambani case is a cautionary tale for all business leaders. It shows that even the most powerful individuals are not immune to the law, and that financial integrity is paramount. The investigation involves potential violations of Indian financial regulations .

The Road Ahead | What to Expect

So, what’s next? What can we expect in the coming months and years? The ED’s investigation is likely to continue, and more assets could be attached. The Adjudicating Authority will review the evidence and decide whether to confirm the attachment of the ₹3,084 crore worth of assets. If the attachment is confirmed, the ED can then proceed to confiscate the assets and use them to recover the proceeds of crime. But, the road ahead is likely to be long and arduous. Anil Ambani is likely to challenge the ED’s actions in court, and the legal battle could drag on for years. What fascinates me is the resilience of the Indian legal system. It’s slow, it’s complex, but it ultimately strives to deliver justice. The case also underscores the importance of financial due diligence for all stakeholders. As per the guidelines mentioned in the information bulletin, the investigation also includes examination of offshore accounts . Let’s hope that this case serves as a wake-up call for corporate India, and that it leads to greater transparency and accountability in financial dealings. Ultimately, the Anil Ambani case is a reminder that success is not guaranteed, and that even the mightiest can fall. It’s a story of ambition, risk, and the consequences of financial mismanagement.

Frequently Asked Questions (FAQ)

What exactly does “attachment of assets” mean?

It means the ED has temporarily seized the assets, preventing Anil Ambani’s firms from selling or transferring them. It’s not a final confiscation, but a step towards that.

What happens if the Adjudicating Authority confirms the attachment?

If confirmed, the ED can confiscate the assets and use them to recover the proceeds of the alleged crime.

Can Anil Ambani challenge the ED’s actions?

Yes, he can challenge the attachment order in court. The legal battle could be lengthy.

What is the Prevention of Money Laundering Act (PMLA)?

It’s a law that allows the ED to investigate and prosecute money laundering offenses and seize assets linked to such crimes.

How does this affect Reliance Group shareholders?

It negatively impacts investor confidence and could lead to a decline in share prices.

Is this the end for Anil Ambani’s business ventures?

It’s a significant setback, but it’s not necessarily the end. The future depends on the outcome of the legal proceedings and the group’s ability to restructure its debt.

In conclusion, the ED’s attachment of ₹3,084 crore of Reliance Group assets is a stark reminder of the importance of financial integrity and accountability. It’s a complex case with far-reaching implications, and it deserves our attention. But what truly lingers is not just the numbers, but the human element – the rise and fall of a business titan, and the lessons we can all learn from his story.

Leave feedback about this